Tenant Screening That Actually Works

Find the right tenants and avoid fraud with the most comprehensive tenant screening available in the market.

No more guesswork — tenant screening you can trust

Did you know? The average eviction costs $3,500. Protect yourself by screening tenants with Baselane.

The only 360° screening

Full Equifax report and the largest database of eviction & criminal history.

No more fraud

Bank-verified income and advanced ID checks that can’t be forged.

Total control, one platform

Sign leases, collect security deposits & rent, and much more — all in one place.

SEE HOW WE STACK UP

Here’s why landlords choose Baselane tenant screening over traditional tenant screening services.

| Traditional Tenant Screening | ||

|---|---|---|

| Comprehensive reports | Credit + Criminal + Eviction + Income | Credit + Criminal |

| Eviction history | ||

| Income verification | Bank, Payroll & Document Verification | Self-Reported |

| 3-way ID verification | ||

| Flexible pricing & reporting | ||

| Integrated rent collection, banking & bookkeeping |

Flexible, transparent pricing — free for landlords

Lower screening costs for tenants, zero fees for landlords.

Basic reporting

Rental application

Includes self-reported information on income, housing history, dependents, pets, vehicles, smoking, and more.

ID verification

Database check, document scanning and facial recognition. Supports 16,000+ ID types and 200+ countries.

Credit report

Instantly receive a full Equifax credit report with payment history and balances across credit accounts.

Enhanced reporting

Add-On

Criminal report $5

Access national and local databases of 1.8 billion criminal records across 2,500+ jurisdictions.

Eviction report $10

Eviction history from the largest database of U.S. housing court records, updated daily.

Income verification $10

Verify applicant income with paystubs and bank transaction data that can't be forged.

Find great tenants and manage your rentals — all in one place

Cut the stress and busywork. One powerful platform for every stage of the rental process, no matter how many doors you manage.

Screen tenants

Sign up for free and send a screening request in 2 minutes.

Sign leases

Choose the best tenant and easily set up and sign their lease online.

Collect rent

Automate rent payments with Baselane’s built-in rent collection.

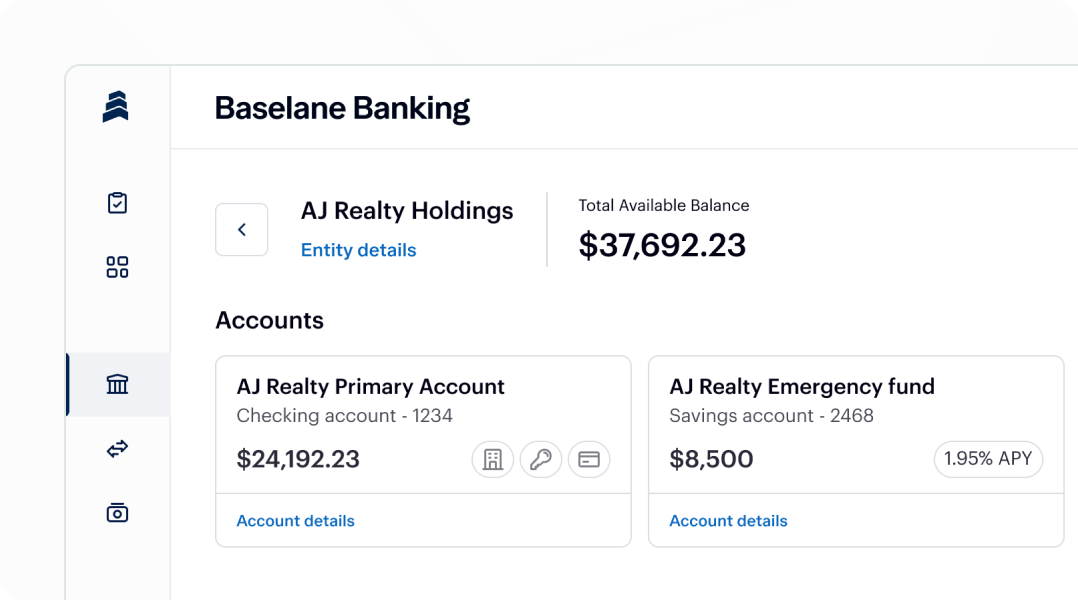

Organize & grow your money with Banking & Bookkeeping built for landlords

hand over the keys with confidence

Choose smart and rent safe with tenant screening you can trust