According to a recent study conducted by PYMNTS Intelligence, roughly 50% of renters prefer paying their rent online. Rent collection apps can make this process easier, faster, and more reliable.

The best apps for landlords to collect rent offer multiple payment options, have easy-to-use interfaces, and keep both tenants and landlords updated on where payments stand.

Choosing the right online tool or app to collect rent payments is essential to the future success of your real estate business. Here are some of the best apps to make rent collection easier and faster.

Best rent collection apps

Before we dive into the pros and cons of each popular platform, here’s a quick overview of the top rent collection apps.

| Rent collection app | Price | Best for |

|---|---|---|

| Baselane | Free for landlords | Landlords looking for an all-in-one rent collection, banking, and accounting platform |

| Apartments.com | Free for landlords | Landlords with basic rent collection needs |

| Rentec Direct | $50+ per month | Landlords with larger portfolios who want to pay for access to advanced features |

| PayRent | $0-$59 per month | Landlords who prioritize high-end features despite higher transaction fees |

| Buildium | $58-$375 per month | Landlords with larger real estate portfolios who want to pay for fast transaction processing |

| TenantCloud | $16.50-$55+ per month | Landlords with multiple properties who need customizable payment options |

| Zillow Rental Manager | Free for landlords | Landlords with fewer properties and basic rent collection needs |

| Avail | $0-$9 per unit, per month | Landlords looking to collect rent and list properties on one platform |

| TurboTenant | $0-$12.42 per month | Landlords who don’t need banking features |

| RentRedi | $12-$29.95 per month | Landlords whose tenants prefer cash payments |

| ClearNow | $14.95 per month for first debit + $2 per additional debit | Landlords who don’t want to offer multiple payment options |

| Innago | Free for landlords | Landlords who want to charge tenants fees for more rent payment options |

1. Baselane

Baselane is an all-in-one banking and finance platform built for real estate. You’ll gain access to automated rent collection for landlords and tenants, plus premium features not found on other platforms, like landlord banking, integrated bookkeeping, reporting and analytics, and much more.

Baselane’s online rent collection service helps landlords save hours every month with automatic payments, late fees, direct deposits, rent reminders, and expense tracking.

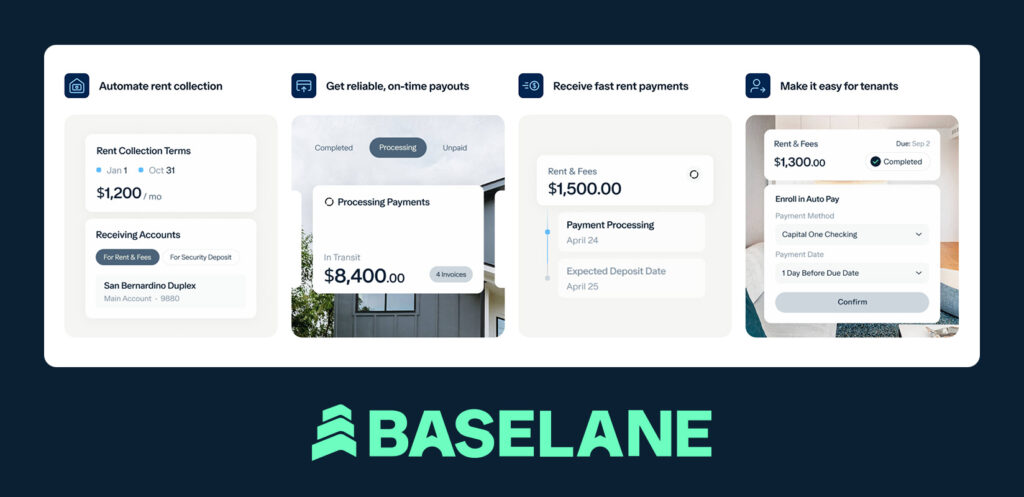

You can collect rent into an existing bank account or Baselane banking accounts for each property and unit. Tenants only pay 3.49% for debit or credit payments, and ACH rent payments are free with a Baselane banking account.

If you use Baselane banking, you can earn up to 3.35% APY<sup>2</sup> and 1% cash back, in addition to enjoying unlimited virtual accounts for rent and deposits, virtual cards to track expenses, and automated bookkeeping to tag transactions by property and expense category.

As an all-in-one property management platform, Baselane also offers tenant screening, online leases, landlord insurance, rental property loans, and other services to manage and grow your rental business.

Key features

- Automated rent collection and reminders: Schedule invoices for rent, security deposits, one-time fees, and recurring fees, and send automatic reminders to reduce late payments.

- Multiple payment options: Let your tenants choose between ACH, debit, and credit card payments.

- Tenant auto-pay: Avoid the hassle of late rent payments. Tenants can sign up for automatic payments in the app.

- Fast payments: Get your money in as little as two business days with QuickPay.

- Direct deposits: When tenants send rent payments with Baselane, those online rent payments will be deposited directly into your account.

- Easy sign-up for tenants and landlords: Just provide a few basic details, and you’ll be able to start collecting rent online in minutes.

- Automated late fees: Automatically charge late fees in the app based on lease terms and grace periods.

- Security deposit accounts: Open unlimited banking accounts to hold each security deposit compliantly and easily return them.

- Payment history and tracking: Track your tenants’ payments, balances, history, and pending payments.

- Rent reporting for tenants: Help your tenants build credit by reporting their on-time rent payments to credit bureaus.

- Renewal notifications: Receive reminders for renewals and easily extend the lease or end it and start screening new tenants in the same dashboard.

- Income and expense tracking: Categorize rental income and expenses in one click with automated bookkeeping for real-time cash flow insights and on-demand reporting.

Pricing

Baselane is free to use. Landlords with both large and small portfolios can collect rent and access premium features for free, with no monthly payments required.

Best for

Baselane is ideal for landlords who want an all-in-one platform for rent collection, banking, and bookkeeping. Our software can easily accommodate all landlords, whether you have a single rental with one tenant or dozens of properties with hundreds of tenants.

| Pros | Cons |

|---|---|

| Automates rent collection for landlords Built-in banking and bookkeeping Fast payments within 2-3 days | No mobile app (coming soon) No tenant messaging on the platform (coming soon) |

2. Apartments.com

Apartments.com is a platform that provides all the basics of online rent collection except for rent payment notifications. The platform lets you collect tenant rent payments online from one or multiple tenants in the same unit with reasonable transaction fees. Apartments.com has additional tools for rental listings, applications, and tenant screening.

However, it’s an older rent portal for landlords with dated visuals and features. There is an expense tracking feature, but you have to manually enter and categorize transactions.

Key features

- Multiple payment options

- Automatic late fees

- Automatic email reminders for tenants

Pricing

Apartments.com is free for landlords but charges tenants a 2.75% fee for debit, credit, or Google Pay transactions.

Best for

Apartments.com is best for landlords who want to collect rent online and who don’t mind using multiple financial property management platforms to manage their business.

| Pros | Cons |

|---|---|

| Low tenant transaction fees Split rent between roommates Partial rent payments (this can be risky for landlords, and we don’t recommend it) | No automatic expense tracking No integrated landlord banking Markets other rentals to tenants |

3. Rentec Direct

Rentec Direct allows landlords to accept multiple rent payment options in the app, including credit, debit, and ACH payments, integrating those payments into their system’s accounting platform.

The rent payment system lets landlords charge tenants full or partial transaction fees for debit and credit card payments. Tenants can also pay rent in cash using the PayNearMe network for $3.99 per transaction. This service costs $200 to set up and requires ten monthly cash payments.

Additional rental property features are included, but you have to pay a monthly fee of $45 for Rentec Pro or $55 for Rentec PM. Pricing can reach over $6,250, depending on how many units you manage.

Key features

- Collect credit, debit, cash, and ACH payments

- Autopay options for tenants

- Easy-to-use tenant portal

Pricing

Landlords have to pay a monthly fee of $50 for Rentec Pro or Rentec PM. Pricing can reach over $6,250 per month, depending on how many units you manage.

Best for

Rentec Direct is best suited for landlords and property owners with larger portfolios who can afford to pay monthly fees and scaled pricing for premium features.

| Pros | Cons |

|---|---|

| Optional same-day ACH deposits ($0.50 per transaction) Mobile apps for tenants and landlords 2-week free trial available | Pricing increases with more units ($50-$6,250+) Monthly fee for multiple merchant accounts ($15 each) Confusing user interface |

4. PayRent

PayRent is a simple online rent payment service with some premium features available at an extra cost The platform accepts ACH and credit card payments. Additional features of the rental payment platform include renter insurance monitoring and automatic rent payment reporting to major credit bureaus.

Payment fees depend on the plan you sign up for. Tenants pay between $0 and $6 for each bank transfer. If tenants choose to pay with a debit card, they’ll pay between 0% and 1% + a debit card fee of $5.95 to $12. All plans charge 3.5% + $5.95 for credit card transactions.

Key features

- Rent collection and credit reporting

- eChecks and credit card payment options

- Block partial payments

Pricing

PayRent offers three pricing models to accommodate different sizes of portfolios. Landlords with fewer than 10 rental units can access a free plan. Landlords with 10-24 units pay $24 per month, and landlords with more than 25 properties pay $59 per month.

Best for

PayRent is best for landlords who want to select premium features and are comfortable with high tenant transaction fees.

| Pros | Cons |

|---|---|

| Tenant rent reporting to three major credit bureaus Real-time bank balance verification Automated renter onboarding | Auto-late fees only on paid plans High transaction fees No support for multiple landlord bank accounts |

5. Buildium

Collecting rent payments online with Buildium requires a paid account that costs anywhere between $58-$375 per month. Tenants are charged between $0.60 and $1.99 for each ACH transfer and 2.99% for debit or credit card transactions. ACH fees for tenants are waived on the costly Premium plan.

Landlords have to pay a $99 setup fee for each bank account receiving rent payments. These high fees can add up, making it less ideal for landlords with small portfolios.

Key features

- Collect credit, debit, and ACH rent payments

- Automated payment reminders for tenants

- Ability to pass fees to tenants

Pricing

The pricing ranges from $58 per month for the Essential plan to $375+ per month for the Premium plan. The more features you want to include, the more you’ll need to pay each month.

Best for

Buildium is best suited for landlords with larger real estate portfolios that more easily offset its setup costs and high monthly fees.

| Pros | Cons |

|---|---|

| Tenant rent payments processed in 1-2 days Bulk updates for convenience fees Recurring credit card payments | $99 for each landlord bank account Customer service limited to support tickets Too many features that smaller landlords don’t need (better suited for property managers) |

6. TenantCloud

The TenantCloud online rent collection service simplifies rent payments for tenants. It accommodates multiple payment methods, including ACH transfers and debit and credit card payments for a fee. Landlords can also adjust rules for due dates, late fees, and partial payments for each tenant as needed.

Their services aren’t cheap. Tenants have to pay between $1.50 and $1.95 for ACH transfers and 3.5% + $0.30 for debit and credit card payments. Rent payments can also take up to seven days to process.

Key features

- Autopay feature for tenants

- E-signature lease agreements

- Online payment history tracking

Pricing

TenantCloud offers different pricing tiers based on the size of your portfolio. Pricing starts at $18 per month for landlords with small portfolios and goes up to $60+ per month for property managers. Paying for the whole year upfront may lock in a lower price for each tier.

Best for

TenantCloud is best for landlords with multiple rental properties who can wait up to seven days for rent payment. Those who need faster processing times may be better off using a different rent payment app for landlords.

| Pros | Cons |

|---|---|

| Supports multiple landlord bank accounts (only on paid accounts) Allows partial rent payments Customizable tenant rent payment options | No free ACH transfers (charges $1.50-$1.95 per payment) Payment processing can take seven days (this is way too long) Basic plan limits the number of properties you can add |

7. Zillow Rental Manager

Zillow Rental Manager allows landlords to collect rent from tenants online. Tenants can send ACH transfers or pay 2.95% for credit card transactions and $9.95 for debit card payments. Roommates are not able to pay rent separately, so one tenant must submit the total rent payment through their account.

Currently, this tool can only link one bank account to receive payments. Adding a new bank account for one property will update all the properties you have set up rent payments for.

Key features

- Payments received in up to 5 days

- ACH, credit card and debit card payment options

- Automated payment reminders

Pricing

Zillow Rental Manager is free for landlords, but some additional features, like rental listings, may require an additional fee.

Best for

Zillow Rental Manager is optimal for small or DIY landlords who handle property listings and tenant screening without a property manager or real estate agent.

| Pros | Cons |

|---|---|

| The ability to market a property and find tenants Collects one-time payments Zillow Rental Manager app | Roommates can’t pay rent separately $9.95 for debit card transactions No P&L reporting or tax reports |

8. Avail

Avail is primarily used as a rental listing site, but it also offers tools to collect the rent. Landlords can schedule upcoming rent payments in advance, and the system will automatically send monthly reminders.

Tenants pay tenants $2.50 for ACH payments and 3.5% for debit and credit cards. If you want access to ACH bank account transfers and next-day deposits, you’ll have to pay to upgrade to the premium plan. This plan costs $9 for each unit per month, so your budget should accommodate this.

Key features

- Autopay features for tenants

- CreditBoost to report on-time payments to credit bureaus

- Expedited payment processing

Pricing

Avail offers a variety of subscriptions that range from $0 to $9 per unit per month. Landlords will need to pay for the service to access premium features like FastPay rent payments and waived ACH fees.

Best for

Avail is best for landlords managing a few properties, offering property listings and automated rent collection, but with monthly fees for most features.

| Pros | Cons |

|---|---|

| Lease creation and signing Next-day rent payments with FastPay ($9/unit) Auto-generated payment receipts | Paid plan charges per unit FastPay only on Premium plan Outdated user experience |

9. TurboTenant

TurboTenant allows landlords to accept rent payments online with features for recurring charges and payment reminders for tenants. It also gives tenants the option to pay with ACH, credit, or debit and lets them set up autopay rent payments. You can add extra features for an additional fee, depending on your business’s needs.

You will have to pay $12.42 a month for the Premium plan if you need more than one bank account or faster payouts than the standard 5-7 business days. With all plans, tenants will pay 3.49% for credit and debit payments and $55 for application fees, regardless of the.

Key features

- Online rent payments and tracking

- Automatic deposits to landlord accounts

- Detailed payment history in the dashboard

Pricing

TurboTenant offers three pricing tiers. Prices range from $0 for the free plan to $12.42 per month for the Premium plan.

Best for

TurboTenant can be useful for experienced landlords who can maximize the value of additional property management features.

| Pros | Cons |

|---|---|

| State-specific leases ($59 each on a free plan) Automatic deposits for landlords Notifications when tenants make payments | $45 application fees for tenants Rent reminders still go out after a tenant pays rent Multiple bank accounts and phone support only on the Premium plan |

10. RentRedi

RentRedi is a property management software platform that includes online rent collection. There are no free plans, but you can choose to pay monthly, annually, or every six months. These fees range between $12 and $29.95 per month, depending on your chosen plan.

Tenants can pay 3.1% + $0.30 to use credit and debit cards or $1 for ACH transfers. RentRedi also accepts rent paid in cash at more than 90,000 retail locations with a Chime account. Cash deposits cost $1 per transaction.

Key features

- Cash, credit card, debit and ACH payment options for tenants

- Autopay options for rent payments

- Ability to set up automatic and recurring late fees

Pricing

RentRedi offers three billing options: monthly, every six months, and annually. Landlords who want to be billed monthly will pay $29.95 per month. Landlords who want to be billed twice yearly (once every six months) pay $20 monthly. Landlords who want to lock in a low rate can choose to be billed annually at $12 per month.

Best for

RentRedi is best for landlords with tenants who primarily pay rent in cash and who are willing to pay for basic features.

| Pros | Cons |

|---|---|

| Accepts cash rent payments Mobile app for landlords and tenants Export rent payments to spreadsheets | No free plans available (might be too expensive for smaller landlords) No free payment options for tenants Deposits take 4-5 days |

11. ClearNow

ClearNow is a basic rent payment collection platform that allows landlords and property managers to receive rent payments through ACH transfers. The platform is easy to use but lacks more robust features, such as multiple payment options and integrated landlord banking services that may benefit larger portfolios.

Their pricing model only charges fees when the platform transfers money from the tenant to the landlord. The system’s simplicity does come with some hefty limitations, like not allowing credit and debit card payments through the system. You can only accept ACH payments.

Key features

- ACH payment network

- Payments deposited in three days

- Rent payments reported to Experian

Pricing

ClearNow fees start at $14.95 per month for the first debit and an additional $2 for each subsequent debit. Bi-weekly and semi-monthly debits are $4 per debit. If you choose to use an additional account for monthly debits on a different day, you’ll pay $7.95 per month for the first debit on that account and an extra $2 per month for subsequent debits.

Best for

ClearNow is best for landlords with one or two rental properties and tenants who don’t want the flexibility of paying rent with debit or credit cards.

| Pros | Cons |

|---|---|

| Auto-debits tenant accounts Offers semi-monthly and biweekly payment options Provides quick processing times | Fees increase with each debit Features are limited Platform looks outdated |

12. Innago

Innago is a property management platform that lets tenants set up automatic payments and sends them payment reminders when rent is due.

The platform lets you set up automated late fee reminders and gives you control over how you bill tenants for rent and other fees. You can also track payments offline, so you know who still owes you and who has paid you on time. Innago makes tenants cover the fees for additional services, including rent payments.

Key features

- Online rent payments

- eCheck and credit card options

- Short hold times on payments received

Pricing

Innago is free for landlords and passes any fees to the tenant. Tenants will pay $2 for ACH payments and 2.99% for credit and debit card payments.

Best for

Innago is best for landlords who want to offer multiple rent payment options to their tenants at a fee.

| Pros | Cons |

|---|---|

| Online rent payment collection Payment tracking to monitor late payments Enhanced security for tenants and landlords | Costly fees for tenants Limited reporting options Confusing interface |

How to choose the best rent collection app

When it comes to collecting rent from your tenants, many landlords and tenants agree that the best way to collect rent payments is online. In fact, 81% of tenants want the ability to make payments online instead of in person. The right rent collection app can improve your tenants’ rental experience and help you get paid faster and with less hassle.

Here are a few key features to look for when exploring your options:

- Ease of use: The best rental payment apps are user-friendly for landlords and tenants. Make sure to choose a platform that’s simple to navigate and easy for your tenants to make monthly payments.

- Different payment options: Choose a platform that offers multiple payment options and consider working with a service that lets your tenants break their monthly rent payments into weekly or biweekly payments.

- Automation: Your rent collection platform should let you set up automated reminders for upcoming rent payments and give your tenants the ability to schedule recurring payments at a minimum.

- Payment processing times: Consider how long each platform takes to transfer money to your account. Baselane deposits payments in 2-5 days, so you’re not left wondering when you’ll see an increase in your bank balance.

- No partial payments: Blocking partial payments for overdue rent should be a standard feature. This will help avoid delays if you’re in the middle of the eviction process.

- Security: Your rent payment collection app should encrypt payment data and account information for both you and your tenants. Ask about the security measures each platform uses before making your decision. Great apps should use data encryption to protect information sent through the platform and two-factor authentication to protect personal information.

- Cost: You have other expenses to cover and shouldn’t have to worry about expensive rent collection service subscription fees. Choose a payment app that keeps tenant-paid fees to a minimum and is free for landlords to set up and use. Try to keep tenant transaction fees below 3% for debit or credit cards and automated clearing house (ACH) bank transfers.

- Additional factors: Consider the types of services you need from your property management software and how those needs may change over time. Choose an app that offers other features to help run your business, like lease agreements, tenant screening, income and expense tracking and more.

Once you find a platform you like, try to stick to it. Tenants typically don’t like switching from one platform to another.

Other features to look for are built-in banking and bookkeeping to help replace manual data entry with automatic income and expense tracking for Schedule E tax reports.

Automate rent collection with Baselane

Collecting rental payments from tenants doesn’t have to be stressful. When you have the right rent collection app to automate rental property finances, you have more time to focus on managing and building your rental business.

Baselane is purpose-built for landlords and real estate investors to simplify the hardest parts of managing rental property finances. Our platform offers online rent collection, landlord banking, landlord accounting software, transaction tagging, cash flow reports, financial statements, and other rental property management tools all in one place.

FAQs

What is the best method to collect rent?

The best way to collect rent from your tenants is the way that works for them. Baselane’s rent collection platform makes collecting rent payments easy, fast, and affordable. Your tenants can choose between ACH, credit card, or debit card payments.

What is the best rental collection app?

The best rental collection app depends on what your needs are now and how they’ll change. Choose an app that’s free to use and offers tons of features that can grow with your business, like Baselane. Through Baselane’s rent collection platform, you can e-sign leases and automatically collect fees, create separate accounts for security deposits, auto-tag transactions for tax reporting, screen tenants, and access other premium features for complete control over your rental finances without monthly fees.

How does online rent collection work?

Every rent collection app is different, but should be easy to set up and use. With Baselane, the setup is quick and simple – it only takes a few minutes.

- Enter your rental’s address, rent amount, fees, lease terms, timing of payments, and your tenant’s information.

- Invite your tenant through the platform.

- Your tenants make one-time or automatic monthly payments through the app.

- You get paid in 2-5 days.

Our online rent collection app aims to save you time and take the stress out of getting paid.

Stress-free rent collection

- Easy setup for landlords and tenants

- Fast payments

- Automated reminders and late fees

Don't miss these

Baselane vs. Avail: Which is the Best Landlord Software?

Deciding between Baselane vs. Avail for your landlord software? Both platforms promise to simplify your life by automating tasks for rental property manage...

3 November 2023

Venmo App vs Baselane: Which Rent Collection App is Better?

When it comes to collecting rent, two popular choices are Venmo and Baselane. How do these two apps stack up, and which is best for rent collection? This a...

18 January 2022

How to Calculate & Track Rental Property Operating Expenses

Calculating your rental property operating expenses starts with understanding these costs. While it may seem like every cost associated with your rental is...

1 June 2023